Depreciation net book value formula

Book Value of Assets. The formula to calculate book value is.

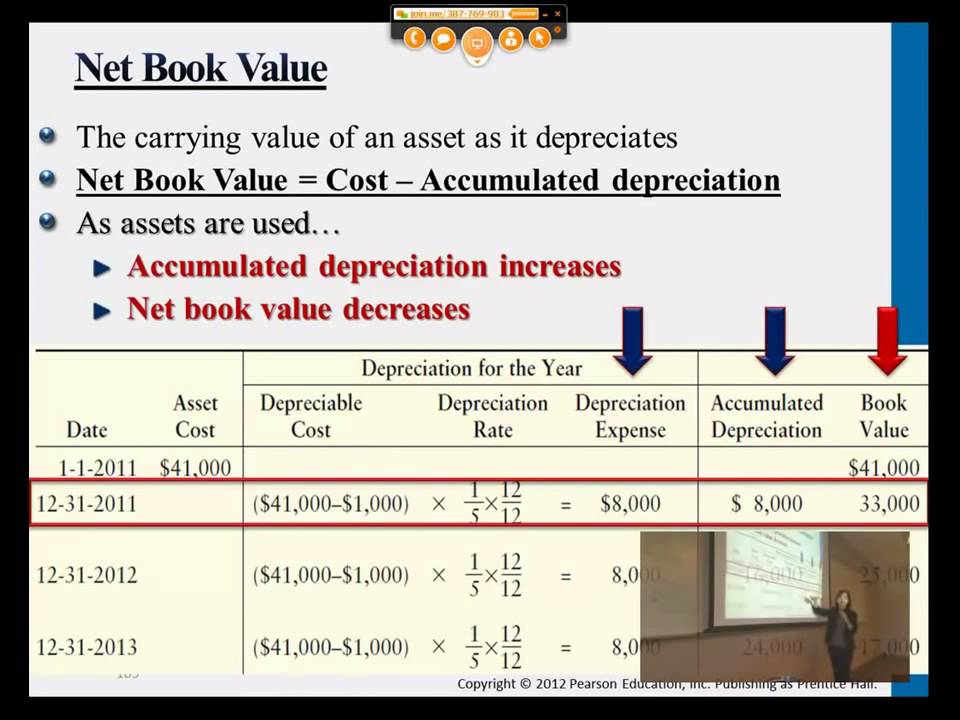

Net Book Value Professor Victoria Chiu Youtube

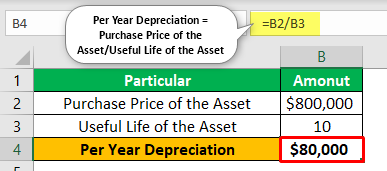

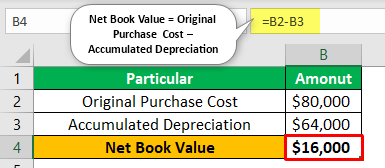

You calculate it by deducting the total depreciation from the purchase cost of the asset.

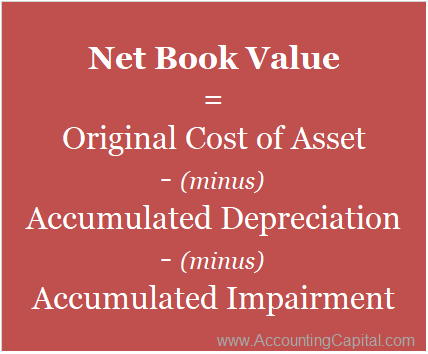

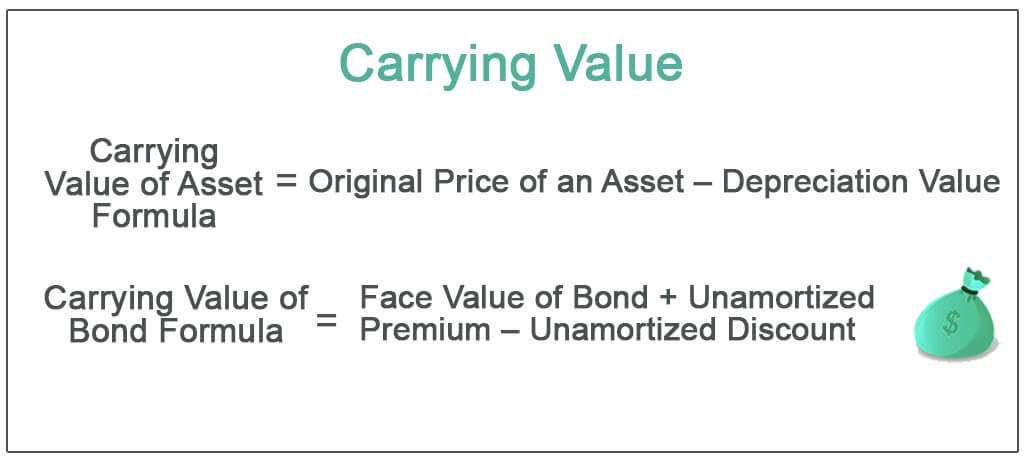

. How to Calculate Salvage Value. Book Value of Equity Formula. The net book value of an asset is the carrying value of the asset on the balance sheet.

2000 - 500 x 30. Net Book Value Cost Accumulated Depreciation. 50000 Cost - 10000 Salvage value 10 Years 4000 Depreciationyear.

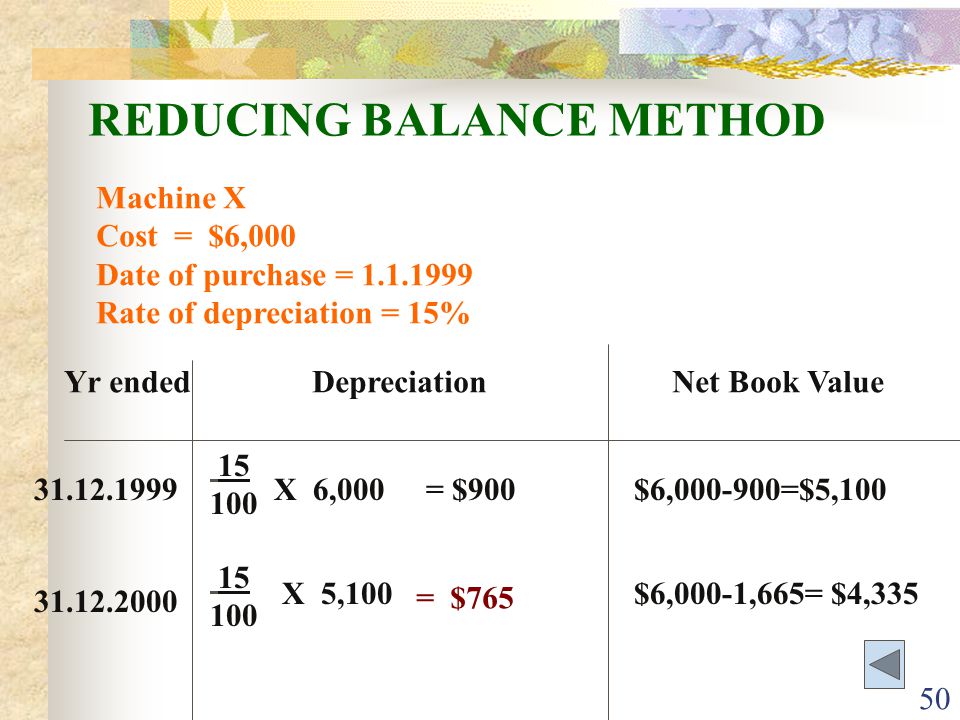

For example lets say you purchased a. For example on Jan 202X company purchase an asset costs 50000 and expects to use it for 5 years and. The formula for calculating the net book value of an asset is to deduct the amount of accumulated depreciation from the cost of the asset.

Net Book Value Original Asset Cost Accumulated Depreciation Original asset cost. For example ABC Trucking Company buys a semi truck for 100000 and depreciates it by 7000 per year for five years. How do you calculate the Net Book Value NBV.

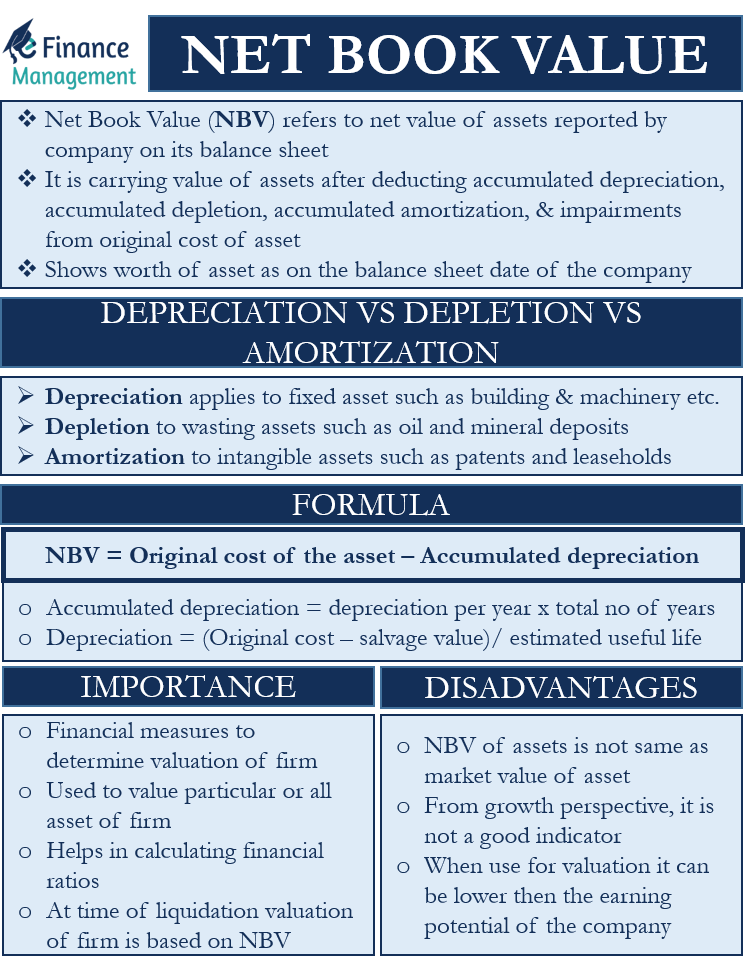

What is Net Book Value NBV. The balance of accumulated depreciation. The book value of a business can be calculated using the balance sheet.

This is the amount that was originally paid for the asset. This means that the vehicle is depreciating at 6250 per year 25000 x 25. The calculation of book value for an asset is the original cost of the asset minus the accumulated depreciation where accumulated depreciation is the average annual.

NBV can now be calculated by subtracting the accumulated depreciation from the cost of the refrigerator and comes to 80667. To calculate the assets net book value at the end of the fourth year. To present it into an equation.

The Prior Year Net Book. 1550 - 500 x 30. The formula for calculating book value per share is the total common stockholders equity less the preferred stock divided by the number of common shares.

What is the net book value formula. As we discussed above net book value equal to the cost less accumulated depreciation. Thus after three years ABC has recorded depreciation of 12000 for the machine which.

Regardless of the method used the first step to calculating depreciation is subtracting an assets salvage value from its initial cost. Net book value is the depreciated value for tax purposes at the end of the prior period. Net book value Historical cost - Accumulated depreciation.

Book Value Initial Cost Accumulated Depreciation. Book Value Cost - Accumulated Depreciation. Depreciation Rate 20 straight.

How Is Net Book Value Calculated. Using the above net book value. The net book value formula is.

Scrap Value of Assets. 25000 - 6250 x 2 12500 After the second year your vehicle assets net book. 80667 1140 - 33333 Everything You Need To.

Net Book Value Meaning Formula Calculate Net Book Value

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Net Book Value Meaning Example How To Calculate And More

Net Book Value Professor Victoria Chiu Youtube

How To Calculate Book Value 13 Steps With Pictures Wikihow

Depreciation Ppt Video Online Download

Carrying Value Definition Formula How To Calculate Carrying Value

How To Calculate Book Value 13 Steps With Pictures Wikihow

Net Book Value Meaning Calculation Example Pros And Cons Efm

Depreciation Of Fixed Assets Double Entry Bookkeeping

.jpg)

Net Book Value Nbv Definition Meaning Investinganswers

Net Book Value Meaning Formula Calculate Net Book Value

Depreciation And Book Value Calculations Youtube

Depreciation Formula Calculate Depreciation Expense

How To Calculate Book Value 13 Steps With Pictures Wikihow

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping

Net Book Value Meaning Formula Calculate Net Book Value