How much money can j borrow for a mortgage

Includes illustrations and loan comparisons Get an Instant Quote by ARLO. Principal interest taxes and.

Never Borrow Money For These 5 Buys Borrow Money The Borrowers Mortgage Payoff

Thats why 30-year mortgages.

. Some 126 billion of Axos assets are loans including residential mortgages and loans on commercial real estate and multi. My wife want to borrow money 8 LAKHS interest free form her mother mother in law and from me through cheque to settle the amount to is family members for releasing one part of their legal heirs property vacant plot. See how much you can expect from a reverse mortgage loan by these 3 popular examples.

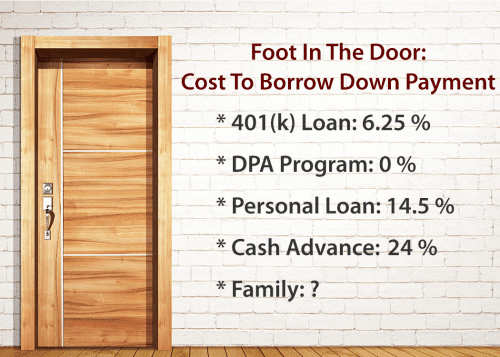

Interpreting HMDA Data American Economic Review 86 1 1996. Before you decide you should weigh the pros and cons of making a large down payment to see what is not only feasible for. That said it may still make sense to pay the full 20 of the homes purchase price if possible.

The new borrower wouldnt have to apply for a new loan pay for closing costs or possibly risk paying higher interest rates. The American dream is very much alive for Frances Tiafoe who thrilled the large crowd of 23000 on Arthur Ashe Stadium once again by moving to within two wins of becoming the first home. I heard the same walls-closing-in anxiety from millennials around the country and across the income scale from cashiers in Detroit to nurses in Seattle.

Total monthly mortgage payments are typically made up of four components. Since a reverse mortgage is a loan you accrue interest on the money you borrow. Your emergency money can go toward paying your mortgage if.

Mortgage loan basics Basic concepts and legal regulation. There is no payment required so. She is also a tax payer.

Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home. Power US Primary Mortgage Origination Satisfaction Study for eight consecutive years.

Size is the amount of money you borrow and the term is the length of time you have to pay it back. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Although the company is deeply rooted in online technology it also has over 3000 home loan experts available seven days a week to help you complete your application over the phone.

Compare Real-Time Rates Eligibility Built-In Program Advice. Return on investment ROI measures how much money or profit is made on an investment as a percentage of the cost of that investment. How much house can I afford.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Debt is an amount of money borrowed by one party from another. If you didnt have a paid-off house and your mortgage was say 150000 youd only be able to access 190000 400000 x 85 150000.

Here a house that the senior citizen owns is mortgaged with a bank which pays a predetermined amount over the period of the mortgage. Ladd Evidence on. If you have no existing balance you can borrow up to 85 of your homes total value.

The idea of a 20 down payment can make homeownership feel unrealistic but the good news is that very few lenders still require 20 at closing. For new home buyers. Check out the latest breaking news videos and viral videos covering showbiz sport fashion technology and more from the Daily Mail and Mail on Sunday.

See for instance Alicia Munnell and others Mortgage Lending in Boston. Please advise me how to borrow money through demand promissory note to avoid any income tax problem. Morgan Chase by comparison holds over 3 trillion in assets.

Transferring a mortgage can simplify things. While your lender is willing to loan you a substantial amount of money that doesnt mean you have to borrow the entire amount if it would put you under significant financial strain. On a home worth 400000 for example thats equal to a lump-sum payment of up to 340000 400000 x 85.

Thus the situation in which borrowing may lead to crowding out is that companies would like to expand productive capacity but because of high interest rates cannot borrow funds with which to. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. To calculate the percentage ROI for a cash purchase take.

Reverse mortgage An additional source of income for senior citizens other than the corpus they have amassed can be a reverse mortgage. A mortgage must go toward the purchase of the listed property and an auto loan must go toward the specified car but a line of credit can be used at the discretion of the borrower. Generally the longer your term the lower your monthly payment.

The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to. The payment typically represents only a percentage of the full. A good rule of thumb is to sock away 3 6 months worth of expenses.

A down payment is a type of payment made in cash during the onset of the purchase of an expensive good or service. Rocket Mortgage NMLS ID 3030 has ranked in the top 3 in the JD. Debt is used by many corporations and individuals as a method of making large purchases that they could not afford under normal.

You could be saving less than that money might have earned had you taken out a mortgage and invested the cash you didnt spend on your house. However many kinds of. Right now rich people can write off mortgage interest on their second home and expenses related to being a landlord or I.

The general rule is that you can afford a mortgage that is 2x to 25x your gross income. After the period is over the ownership of the house is transferred to. Earlier this year she had to borrow money to file for bankruptcy.

More importantly a fall in fixed investment by business can hurt long-term economic growth of the supply side ie the growth of potential output. The Federal Reserve System also known as the Federal Reserve or simply the Fed is the central banking system of the United States of AmericaIt was created on December 23 1913 with the enactment of the Federal Reserve Act after a series of financial panics particularly the panic of 1907 led to the desire for central control of the monetary system in order to alleviate. 1049 The average annualized return of the SP 500.

Apply Online Today Get Approved Car Title Loans Only With Canadian Title Store We Provide Loans In Calgary Alberta And T Edmonton Alberta Alberta Car Title

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Mortgage Calculator How Much Can I Borrow Nerdwallet

How Do Lenders Know If You Borrow Your Down Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

How Much A 200 000 Mortgage Will Cost You

Mortgage Calculator How Much Can I Borrow Nerdwallet

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Pin On Home Buying Tips And Tricks

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Can I Borrow Depending On My Deposit Mozo

What Is A Reverse Mortgage Money Money

How Much House Can I Afford Calculator Money

Get Knowledgeable About Cost And Working Of A Loan Before Borrowing Scoopify Lotto Gewinnen Lotto Spielen Lotto

Mortgage Calculator How Much Can I Borrow Nerdwallet

Credit Score Chart And How This Helps You Get The Lowest Interest Credit Score Chart What Is Credit Score Credit Score